Insurance claims filed after accidents require insurers to prioritize effective claims management to ensure error-free claims processing process flow and minimize additional challenging circumstances for a patient.

Falsehoods in claims processing can result in monetary losses for policyholders. Also, balancing human interaction and automated processes adds to the complexity of claims processing in healthcare. Thankfully, there are several effective approaches to dealing with insurance claims data that can help the claim handling process.

Why Improving the Claims Process Matters

Invoca’s study reveals that a single negative experience can lead to a 76% likelihood of customers ceasing business with a company. Conversely, 63% are willing to spend more for superior customer service. Hence, improving claims management process in healthcare, ensuring a positive customer experience, and providing excellent customer service will help retain customer loyalty and improve customer satisfaction while overcoming claims management challenges.

Claims Management Challenges

Multiple Touchpoints: One of the challenges in steps in claims processing is multiple touchpoints. The claim management process is complex and involves multiple touchpoints, which creates a risk of inconsistent experiences. Even though the automation of claims processing can help, insurance companies must implement automation solutions that will complement human interactions rather than replace them since balancing these two approaches achieves personalized and meaningful customer experiences during the insurance claims management process in healthcare.

Diverse Customer Needs: Since customers will pay more for quality services and have raised their expectations, insurers face the challenge of serving a diverse customer base, from tech-savvy individuals to those less familiar with technology. Besides education and support, insurers must integrate technologies that streamline commercial insurance claims management for both policyholders and internal teams.

Emerging Technology Overload: Blindly adopting new technologies can complicate workflows since providers must ensure seamless compatibility with existing systems. Even though strategic evaluation takes time and requires resources, it allows for choosing and integrating a solution that benefits the core of the claims management process in insurance without disrupting it.

Healthcare Fraud: According to the National Health Care Anti-Fraud Association (NHCAA), fraudulent activities lead to substantial financial losses, estimated in the tens of billions annually. Fraud in healthcare also messes up the integrity of the healthcare system by distorting the accuracy of information and damaging the reliability of claims management systems. Fraudulent activities take up patients’ precious time since insurance providers must distinguish between genuine and falsified claims.

Legacy Claims Systems: Maintaining legacy claims systems can impede adaptability to changing customer requirements. Furthermore, supporting legacy systems, especially with the new modern solutions on the market, can be challenging, leading to fewer specialists capable of maintaining such systems.

Insurers who evaluate their systems regularly while keeping up with the industry-proven solutions and practices can tackle these issues and develop a claims management process that’s efficient, customer-focused, and covers all of the changing needs of the insurance industry.

The Best Approaches to Data Management for Improving the Claims Management Process in Healthcare

Using the Power of Data Standardization and Processes Automation

Claims processing is an essential stage of claims management, including adjudication, submission, and payment. Often, these processes can be complicated due to verbal knowledge, which may lead to inconsistencies in information.

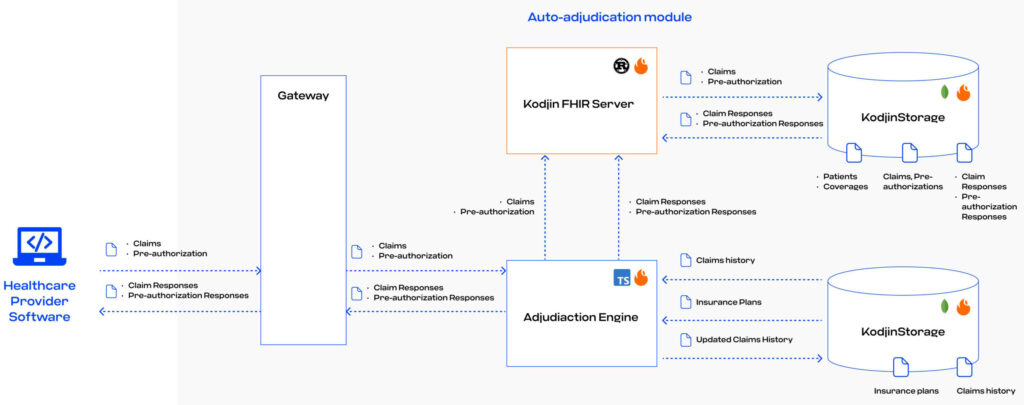

The auto-adjudication engine automates claim/pre-auth processing, minimizing the possibility of error during the manual data input.

Edenlab’s team helped one of the largest third-party administration (TPA) companies overcome these challenges and implemented FHIR to handle fragmented data and complex manual workflows that impede efficiency.

Challenges Addressed by FHIR Implementation:

- Unifying Data Exchange: Harmonizing data exchange from diverse providers and insurers is a common issue in claims processing. By mapping custom data structures to FHIR standards, you can facilitate seamless communication and standardized data exchange.

- Structuring Insurance Plans: To take advantage of the auto-adjudication engine functionality, you must first formalize and structure insurance plans. FHIR’s flexibility can create custom FHIR profiles for key elements that cover any specific use case, enabling a more organized and structured approach to claims management.

- Data Fragmentation: FHIR’s standardized approach ensures data integrity by providing a standardized framework for automating complex processes and reducing the risk of incomplete information, which results in more accurate adjudication outcomes.

Data standardization within the insurance industry is no less important than the standardization of EHRs since, in the US, improper payments for Medicare Free-for-Service claims are represented in dozens of billions of dollars.

Tackling the data fragmentation challenge and implementing automation can reduce costs by minimizing improper payments and improving claims processing systems efficiently.

Enhancing Claims Management by Ensuring Data Accuracy

Besides leading to improper payments, mistakes in claims processing can cause financial losses and delays for patients. In our article on the role of data validation in healthcare, we shared a real story that illustrates the challenges that come with errors in filling out critical insurance documents like the Explanation of Benefits (EOB).

The EOB is a document that outlines the services provided, the total charges from the doctor or hospital, the coverage details, the agreed-upon insurance payment, and the patient’s financial responsibility. Errors in the EOB can lead to payment delays and unnecessary expenses for the patient. In cases where claims processing follows an emergency healthcare situation for a patient, dealing with the consequences of improperly processed claims may foster a patient’s frustration and result in losing a client for an insurance provider.

FHIR’s Role in Data Accuracy:

There are many benefits and operations of FHIR apart from data standardization for future-proofing insurance claims management processing in the following way:

- FHIR can ensure the accuracy of insurance claim processing by validating data types. For example, validating the information in the form of codes (e.g., status field) ensures precise claims processing.

- FHIR’s value set binding is the operation that can link the information to acceptable values, thus initiating alerts when errors occur so they can be corrected immediately without affecting the results of claims processing.

- FHIR ensures vital information is included when processing claims-related documents. Setting up cardinality rules for elements like patient identifiers helps to avoid missing necessary information, which leads to errors or delays in processing claims.

Final Thoughts

FHIR has many options for ensuring the accuracy and consistency of healthcare data. However, it is crucial to know how to implement FHIR to cover the specific needs of a system involved in the claims management processes. Thanks to FHIR’s flexibility, proprietary documents can be mapped to a FHIR format to standardize claims-related data and leverage the advantages of FHIR operations.

FHIR provides powerful tools for building future-proof claims systems. By mapping proprietary documents into standardized FHIR formats, you can unify data, reduce risk, and streamline claims management in insurance.

For a deeper understanding of how FHIR can specifically address your claims management needs, our team of FHIR experts is ready to provide quality custom FHIR development services and share valuable insights gained when successfully using FHIR to optimize claims processing. A well-structured FHIR server implementation is essential for ensuring smooth data validation and interoperability within your claims processing infrastructure. Feel free to reach out and discuss a strategy for tailored implementation of FHIR that will optimize your claims processing system’s efficiency and reliability.